CERS Pension Recommendation Summary

A consulting group retained by the Commonwealth both to assess the state’s pension systems and provide recommendations for improving its massive unfunded liability, issued its final report on Monday, August 28 to a pension oversight committee. The consultants recommended changes to the way the state calculates its own required contribution to the system, but perhaps more important to active state and county employees, they also proposed significant changes to the benefit structure. It is important to note that these are simply the recommendations of a third-party consultant; they have not taken the shape of a legislative proposal.

There were recommended changes to CERS in both the hazardous (CERS-H) and non-hazardous (CERS-NH) plans, and for both future hires and active employees. (While this focuses on CERS for the purposes of this e-mail, the changes on the employee side are the same for employees in CERS and KERS.)

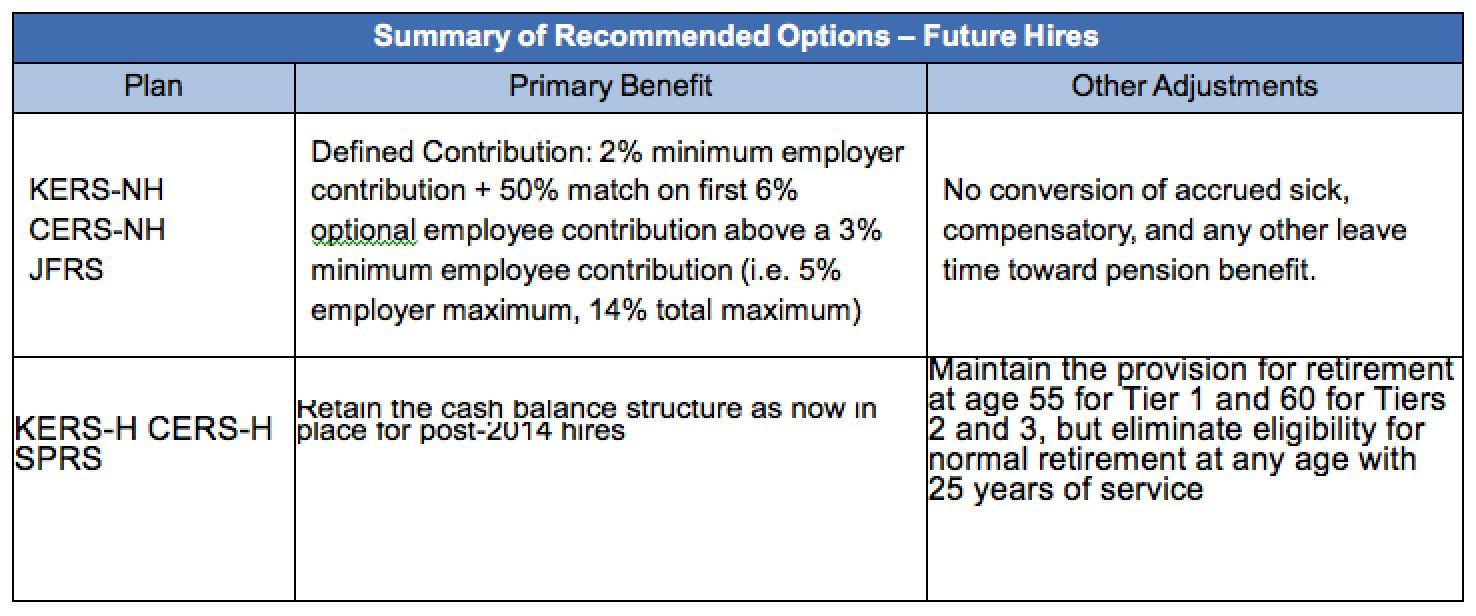

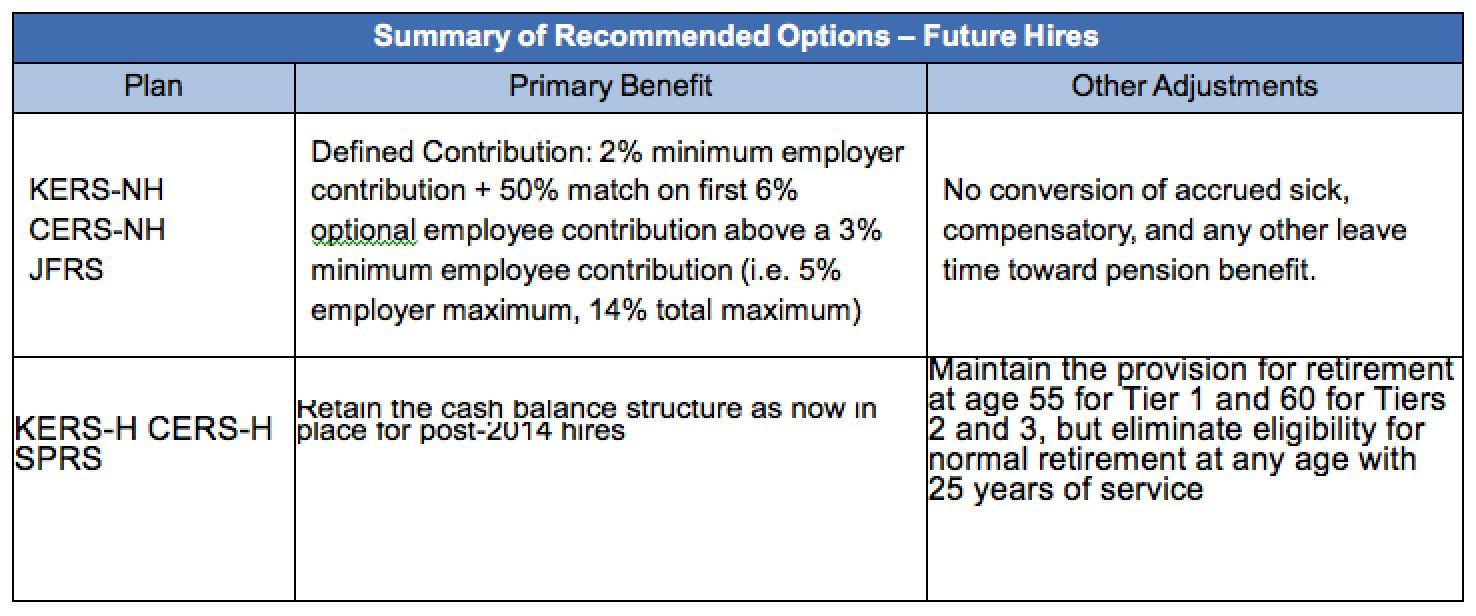

- Future CERS-NH: all future hires will be moved into a defined contribution/401(k)-style plan. Active Tier 3 members (those beginning after 1/1/2014) will have their accounts automatically rolled into a 401(k) plan.

- Max total contribution of 14% (incl. 5% max employer match).

- Employer contribution would vest 100% at 5 years and 50% at 4 years.

- Participants would be eligible for unreduced retirement at age 65.

- No conversion of accrued sick, comp, and any other leave time toward pension.

- Future CERS-H: all future hires they would get the cash-balance hybrid structure that is currently in place for Tier 3 hires.

- Retirement age would be 60.

- There is no consideration for years of service when calculating retirement eligibility.

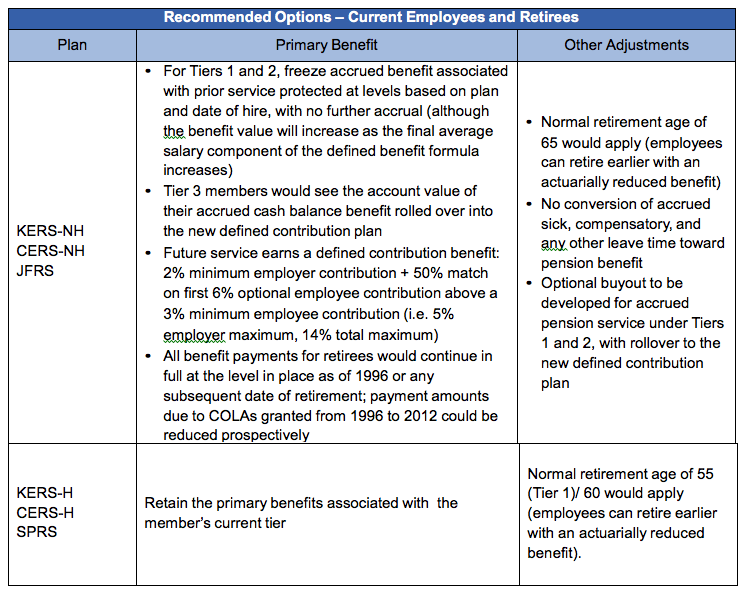

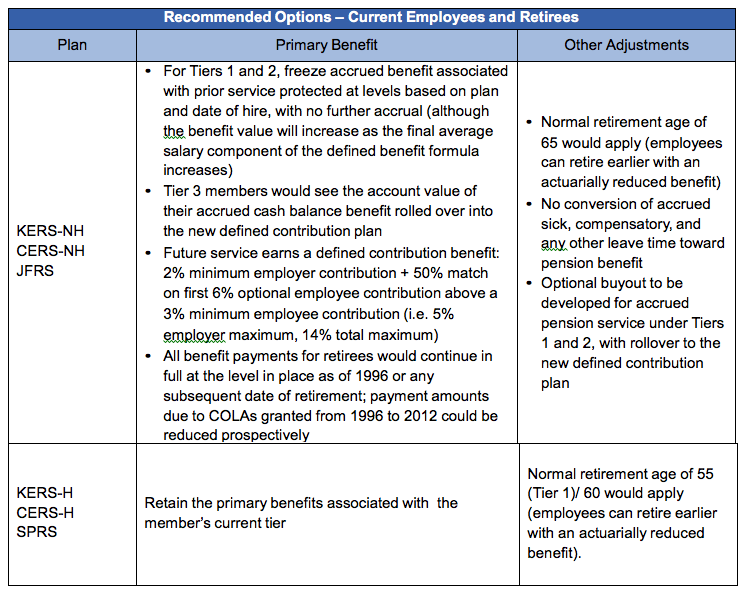

- Active CERS-NH: current employees in Tier 1 (pre-9/1/2008) and Tier 2 (9/1/2008 – 12/31/2013) will have their defined benefit largely “frozen” at a date certain, with subsequent benefits accruing in a defined contribution plan.

- Benefits accrued based on plan type and date of hire will no longer grow.

- The portion of the defined benefit plan based on salary may grow according employee salary growth.

- At a future date, service benefit accrues into a 401(k) plan with a 14% maximum match (incl. a 5% max employer match).

- Full retirement age of 65 with reduced benefits for earlier retirement.

- There will be no conversion of accrued sick, compensatory or other leave times toward the pension benefit.

- An optional cash buy-out would be offered with a rollover into a defined contribution plan.

- Portion of benefit resulting from cost of living adjustments (COLAs) between 1996 and 2012 will be eliminated.

- Active CERS-H: current hazardous duty system members will retain the primary benefits associated with the member’s current tier, with no provision to retire earlier based on years of service.

- Normal retirement age of 55 (Tier 1)/ 60 would apply

- Employees can retire earlier with an actuarially reduced benefit).

- From a funding perspective:

- Explore caps or collars on the annual percentage change in the required overall employer contribution percentage for CERS-NH and CERS-H. Participating employers in the CERS plans are required by law to pay the full ADEC in each year, and have done so over time. Changes in actuarial assumptions and losses due to experience can cause sudden and volatile changes in the ADEC. Although deviating from making the actuarially required contribution on a sustained basis is a concern, a cap on how much the employer contribution percentage may change from year to year can help smooth budgetary increases over time while the benefit liabilities are consistently and conservatively valued across all plans on a transparent basis. For example, the employer contribution percentage could be allowed by statute to increase or decrease by no more than 5-10% in an individual fiscal year.

- Offer an optional buyout/conversion of accrued service program to employees other than those in the cash balance plan for KERS-NH and CERS-NH members. The employees in the cash balance plan would have a mandatory conversion of their accrued benefit to the deferred compensation plan. The optional buyout would be based on the actuarially accrued benefit through the date of the proposed freeze or conversion to a DC plan. This mechanism would be similar to what was offered in KRS 61.522, which provided for nonprofit nonstock corporations participating in KRS to withdraw from the system by funding their liability. Employees had the option to leave their accrued service with KRS until retirement, or withdraw their account balances, which are defined as the employee’s accumulated pension contributions based on the 5% of pay contribution rather than the accrued benefit, and roll it over to the new tax-deferred retirement program offered by the employer. Two employers to date, Kentucky Employers’ Mutual Insurance (KEMI) and the Commonwealth Credit Union (CCU), have used KRS 61.522 to withdraw from KRS. KRS provided KEMI employees with a 60-day notice period to declare their intent to transfer to the new KEMI plan. It is our understanding that, by offering in parallel both a DB plan that would maintain the previous benefit structure and carry over the employee’s service credit from the KRS plan, and by offering a DC plan with an employer match of 50% or 100% of the employee’s account balance, KEMI incentivized all of its employees to transfer from KRS to KEMI. The voluntary buyout would allow employees who would prefer to manage their own assets in a DC plan to convert their benefit from the fixed DB plan to a lump sum beginning account balance in the DC plan, on a tax-exempt basis. Since the conversion would be voluntary on an employee-by-employee basis, any applicable rights under the inviolable contract provisions would not be abridged. This conversion would remove the liability from the retirement system, value the employee’s accrued service as of the date of the conversion without applying future pay increases to the frozen portion of the benefit – improve the funded ratio and reduce risk to the plan.

- The proposal includes a recommendation to consolidate retirement boards, not to offer CERS full separation from KERS.

|